|

|

The Fractionally Integrated GARCH process, or FIGARCH, has been introduced by Baillie, Bollerslev and Anderson Baillie et al. [1996] in order to include a long memory in the volatility. The idea of the derivation is to note that, often, in empirical fits of GARCH processes, the estimated coefficients are such that ∑ i=1αi + βi ≃ 1 . This may indicate that the GARCH process is misspecified, and an integrated process should be used instead. (as a caveat, this diagnostic can be misleading due to the nearly degenerate log-likelihood surface that can induce a minimization algorithm to a spurious convergence, see Zumbach [2000] for more details).

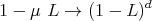

In order to simplify the key idea of the model, consider the simplest case of GARCH(1,1), for which α + β = μ = exp(-δt∕τ). The lag one operator is denoted by L, namely (Lx)(t) = x(t - δt) for all time series x. The essential idea of the derivation is to use the substitution, for μ ≃ 1,

| (1) |

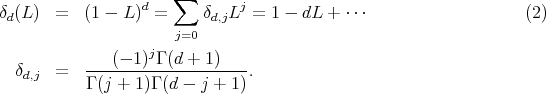

The new term (1 - L)d is a fractional difference operator, defined through a Taylor expansion in the lag operator

| (4) |

The complete derivation for the GARCH(p,q) process is given in the original article Baillie et al. [1996].

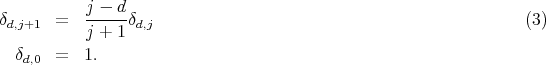

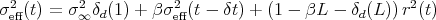

The implementation of the FIGARCH process presents an important practical difficulty related to the cut-off of the fractional difference operator, as already pointed out first by Teyssière [1996] and Chung [1999]. These references have unfortunately not been published, but this problem is reviewed in details in Zumbach [2004]. In practice, the expansion of the fractional difference operator has to be cut-off at some upper limit jmax. The cut-off of the infinite sum implies that the identity δd(1) = 0 is not true anymore. This identity appears when taking the unconditional average of the above equation, in order to compute the mean volatility. For the differential operator with a finite cut-off, taking the average of the Eq. 4 and using E[r2] = E[σ eff2] = σ ∞2, we obtain that ω fixes the mean volatility. Therefore, the affine FIGARCH process, or Aff-FIGARCH(1,d, 0), is defined by the equation

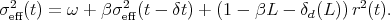

| (5) |

and the affine parameter σ∞ fixes the mean volatility (notice the confusion between the “Integrated” included in the process name and the linear/affine structure of the equation). The condition β < d enforces the positivity of σeff. A modification of this equation allows to define a linear FIGARCH process (see Zumbach [2004] and Zumbach [2012] for a complete discussion and more references on these processes).

The affine FIGARCH(1,d,0) process has three parameters (σ∞,β,d) (whereas the linear FIGARCH process has two parameters (β,d)). The parameters for the numerical simulations are:

For this parameter values for d and jmax, we have δd(1) = 0.0607.

The innovations have a Student distribution with 3.3 degree of freedom. The simulation time corresponds to 50 years with a time increment δt = 3 minutes.

Richard T. Baillie, Tim Bollerslev, and Hans-Ole Mikkelsen. Fractionally integrated generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 74(1):3–30, 1 1996.

C.F. Chung. Estimating the fractionally integrated GARCH model. Unpublished working paper (National Taiwan University, Taipei, TW), 1999.

G. Teyssière. Double long-memory financial time series. QMW working paper 348 (University of London, UK), 1996.

Gilles Zumbach. The pitfalls in fitting GARCH processes. Advances in Quantitative Asset Management. Kluver Academic Publisher, 2000. ISBN 0-7923-7778-8.

Gilles Zumbach. Volatility processes and volatility forecast with long memory. Quantitative Finance, 4:70–86, 2004.

Gilles Zumbach. Discrete Time Series, Processes, and Applications in Finance. Springer Finance, 2012.